givve® Card - Change of acceptance points

Since 15.12.2021, the possible uses of your givve® Card have changed - as a result, there will be many new options for you.

Current information on your givve® Card

All non-monetary benefit cards in Germany - such as the givve® Card - must be adapted to new legal requirements. Due to this, the use of the givve® Card has been limited as of December 15, 2021. This is givve®'s response to a change in Section 8 (2) Sentence 1 of the German Income Tax Act (EStG), according to which non-cash benefits must meet the criteria of Section 2 (1) Number 10 of the German Payment Services Supervision Act (ZAG) from 2022 on in order to continue to be assessed as tax-exempt non-cash benefits and not as taxable cash benefits.

Since Dec. 15, 2021, only certain points of acceptance are available to you as part of the legal requirements for paying with the givve® Card. Your employer will decide which of the 2 following setups your card will be set to from 15.12.2021. Depending on the setup, you are able to use the givve® Card within the scope of the respective application options. We are already working on a function that will allow you to change the setup of your givve® Card yourself - we will keep you up to date on this.

Overview

On this page you will find the most important information and news about the change from 2022:

Don't worry: Your credit will not expire! You can continue to use it - but only with the acceptance partners of the respective selected setup.

Your employer will choose 1 of 2 possible setups

Your desired Setup

As a card user, you too can decide how you want to set up your givve® Card. Technically, however, this is not possible at such short notice.

- Therefore, for the time being, only your employer can select the setups for the company's cards.

- In the second step, you as a card user will also get the opportunity to select your preferred setup. As soon as this technical feature is implemented in givve® Card App/Portal.

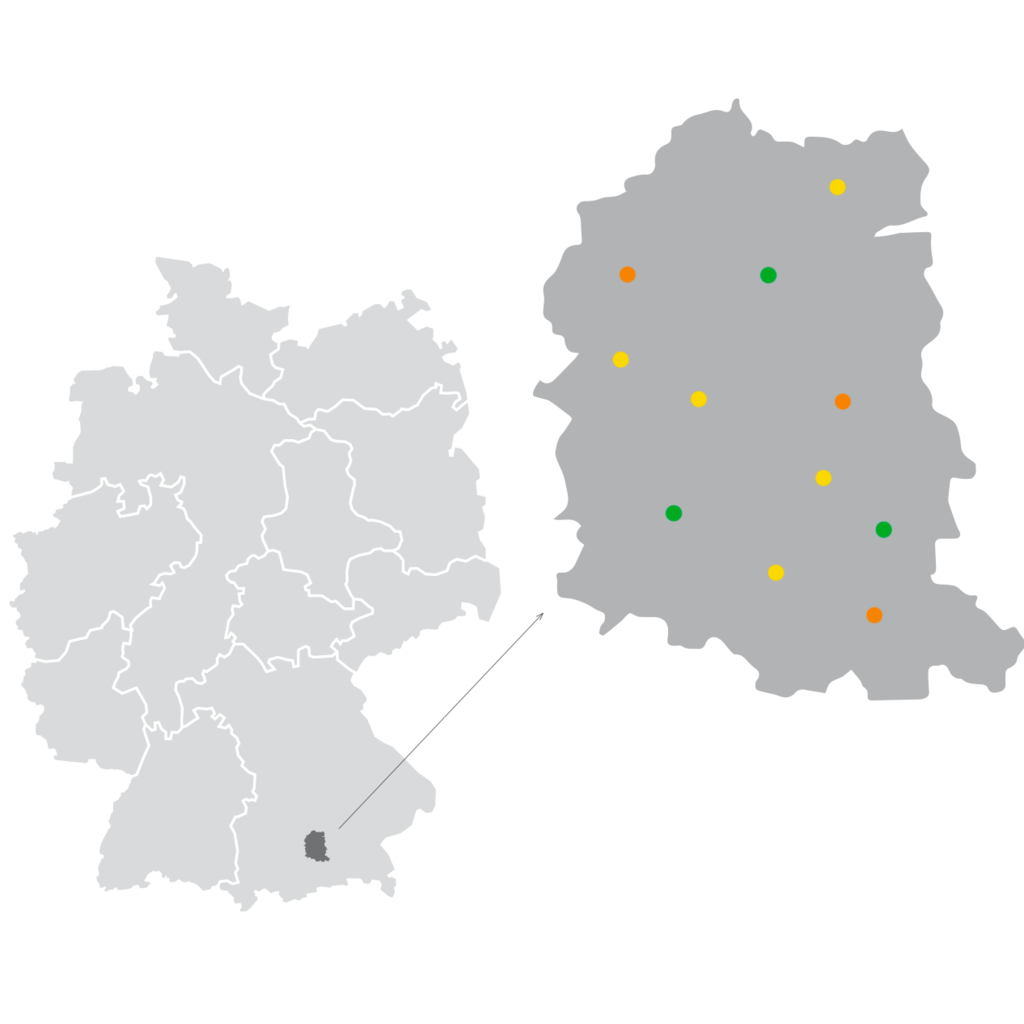

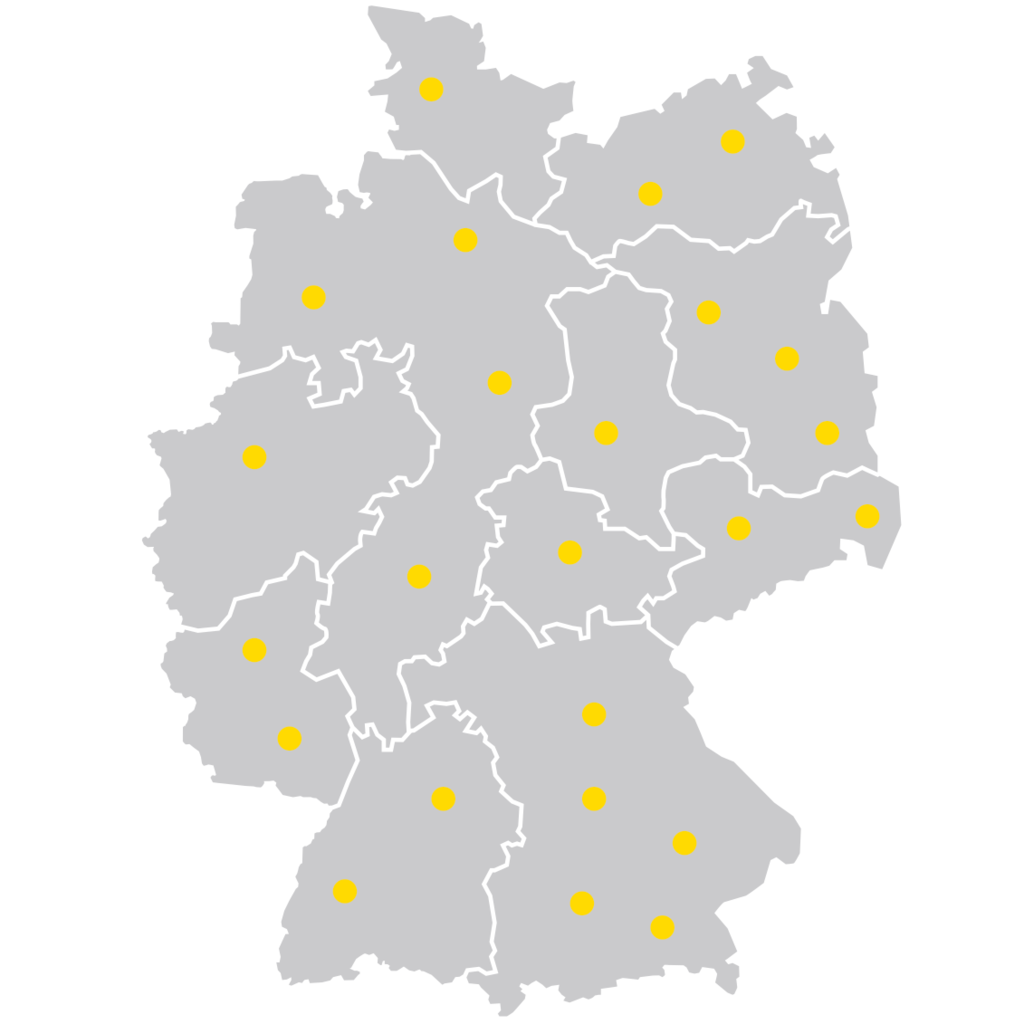

Select a region for my card

You can select the region in which you would like to shop and pay with your card in the givve® Card app or in the portal. With your choice, you help your employer to consider your selection in case of a setup change. Please note that a change can currently only be made by the employer if the card balance is 0 euros.

Further important information:

- Your preferred region does not have to be your place of residence or your place of work - you are free to choose!

- You can enter your desired region under Settings - My Card in the givve® Card Portal or the app.

- You can change your desired region at any time in the givve® Card Portal or the app in the settings under "my card".

Where can I use my card in the future?

Depending on the setup you choose, you will be able to use your givve® Card to pay either at many suppliers from a selected region or at a selected supplier throughout Germany.

Which providers/merchants belong to the respective setup?

At the moment we cannot provide an overview of the acceptance partners, this will be published soon.

Why must the card be restricted from 2022?

- As of 2022, all non-cash remuneration solutions in Germany must be adapted to the new legal requirements. Due to this, the card use of the givve® Card will be limited from 15.12.2021.

- givve® is thus responding to a change in Section 8 (2) Sentence 1 of the German Income Tax Act (EStG), according to which non-cash benefit cards, such as the givve® Card, must meet the criteria of Section 2 (1) Number 10 of the German Payment Services Supervision Act (ZAG) from 2022 onwards in order to continue to be assessed as a tax-free non-cash benefit and not as a taxable cash benefit.

*Please note: We may not provide legal or tax advice. The information provided here is to be understood as general information on our product, the givve® Card. We ask you to have your tax or legal advisor thoroughly review the details relevant to your issues from a tax and legal perspective to ensure the best possible use of our product for you. We do not assume any liability.